Push 2 Payment

Introduction

Push Payment is a mobile application for payment platform in the form of e-money and its uniquely directly connected to the user's user account. For push payments, buyers accept and approve invoices and send payments, as is the case with pull payments. However, for push payments, the transaction process will automatically expire and the money will be paid directly into the seller's account. ACH, account payments and direct deposits are examples of push payments. With lower transaction costs and easier reconciliation processes, push payments are often used to convince suppliers to accept credit card payments.

In the field of digitization, payments for the future will be made easier. As with the PUSH2PAY payment method, ESPAY indirectly invites its users/customers to move closer to the era of digitization via the Internet and smartphones. In addition, users also get benefits like:

- User-friendly payment (Very SIMPLE, seriously!)

- Safer payment

- A better experience for users

For this payment method, previously required entities were:

Becomes,

With the convenience that payments offer, transactions become more enjoyable. It gives users a much better transaction experience than before.

"Payment methods that change your transaction experience"

Authentication

Each request will be verified by basic authentication, so every request sent must include the authorization Header, with the basic value followed by username and password, with username:password format that has been encoded with Base64 encoding.

Example :

Username: Romeo

Password: Juliet

Format before being encoded :

Romeo:Juliet

Base64 encoding result :

Um9tZW86SnVsaWV0

Header sent :

Authorization : Basic

Um9tZW86SnVsaWV0

Failed authentication will receive http 401 header

Parameter Request & Parameter Response

Web Service to Push to Pay to Payment Application

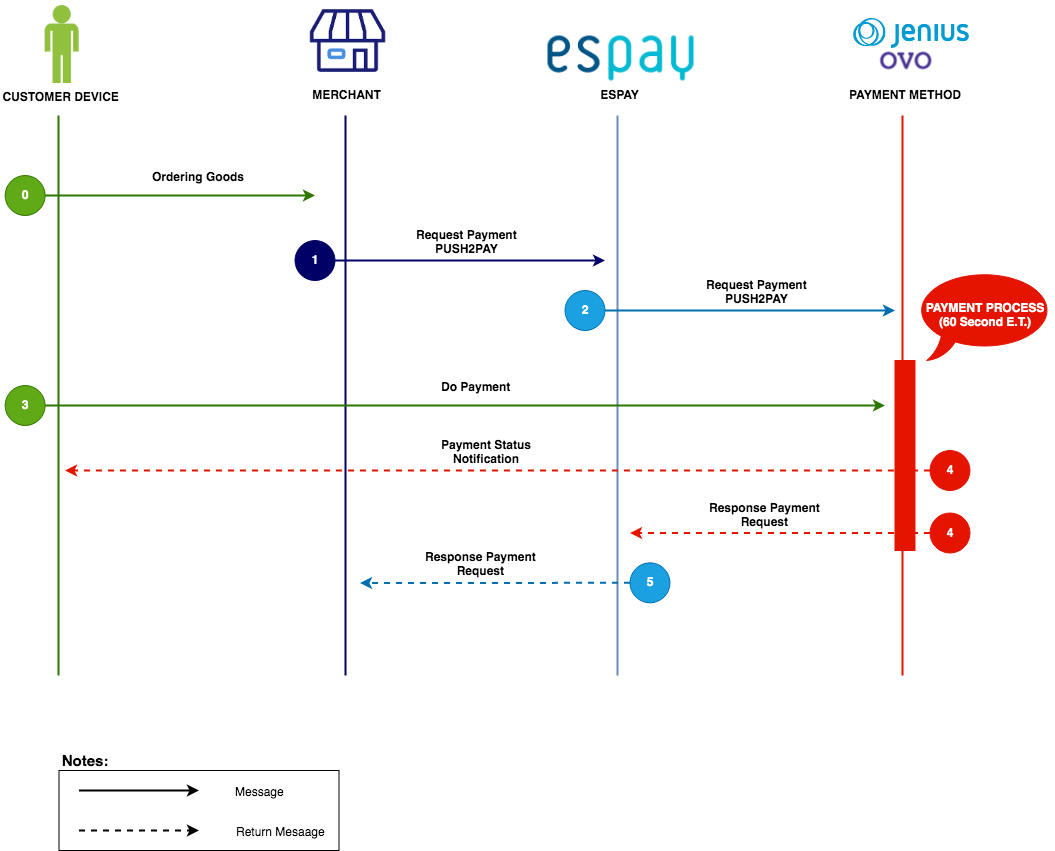

Message Flow

Merchant → Espay

Method

HTTP Post

API URL

Endpoint Development: https://sandbox-api.espay.id/rest/digitalpay/pushtopay

Endpoint Production: https://api.espay.id/rest/digitalpay/pushtopay

Parameter Request:

| Name Field | Attribute | Mandatory | Description |

| rq_uuid | 64 | Yes | Request identifier. Unique ID to identify these messages with other messages |

| rq_datetime | 19 | Yes | Date and time on the Espay application server when the message was sent |

| comm_code | 32 | Yes | The seller code is registered in the Espay application |

| order_id | 20 | Yes | Transaction number / invoice ID / unique ID that identifies the order / invoice / invoice |

| product_code | 10 | Yes | The desired product code. Push to Pay :

|

| amount | 13 | Yes | Number of invoices to pay |

| customer_id | 64 | Yes | Customer data

|

| promo_code | 64 | No | Promo Code |

| is_sync | 1 | No | 1 = Sync / 0 = Async Default Async |

| branch_id | 64 | Optional | Branch ID |

| pos_id | 64 | Optional | POS ID Machine |

| description | 20 | Yes | Order description |

| signature | 64 | Yes | Validation by the seller requires a signature |

Parameter Respone:

| Name Field | Attribute | Mandatory | Description |

| error_code | 4 | Yes | If error_code equal 0000 = Successful If error_code is not the same as 0000 = Failed to call request to Payment Application |

| error_message | 32 | Yes | If error_code equal 0000 = Successful If error_code is not the same as 0000 = Failed to call request to Payment Application |

| trx_id | 32 | Yes | Transaction ID of Espay |

| QRLink | 64 | Yes | URL QR https://api.espay.id/gojek/QR/uafu-134fd-erdf-353--erdf-353-/ |

| QRCode | BLOB | Yes | data:image/jpeg;base64,/9j/4AAQSkZJRgABAQAAAQABAAD/2wBDAAgGB gcGBQgHBwcJCQgKDBQNDAsLDBkSEw8UxwcKDcpLDAxNDQ0Hyc5PTgyP….. |

| order_id | 20 | Optional | Transaction number / invoice ID / unique ID that identifies the order / invoice / invoice |

| customer_id | 32 | Optional | Customer data

|

| trx_status | 2 | Optional | Transaction Status |

| amount | 13 | Optional | Invoice Amount |

| approval_code | 64 | Optional | Approval code, reference of Bank |

| product_code | 10 | Optional | Product code |

Signature

Each request must be signed for validation. The customer receives a secret key in a separate document. The key is processed into a signature using the following steps:

Step 1 :

Combine the parameters used in the following order:

##rq_uuid##comm_code##product_code##order_id##amount##mode##key##

Example :

rq_uuid : 123ABC-DEF456

comm_code : MYCOMMCODE

product_code : OVO

order_id : ORDER001

amount : 10000

key : S3cr317kEY

mode : PUSHTOPAY

The string is as follows:

Result = ##123ABC-DEF456##MYCOMMCODE##OVO##ORDER001##10000##PUSHTOPAY##S3cr317kEY##

Step 2 :

The results of step 1 in capital letters are as follows:

##123ABC-DEF456##MYCOMMCODE##OVO##ORDER001##10000##PUSHTOPAY##S3CR317KEY##

Step 3 :

Hash results from step 2 with sha256:

$sha256 = hash(sha256, '##123ABC-DEF456##MYCOMMCODE##OVO##ORDER001##10000##PUSHTOPAY##S3CR317KEY##')

Result = aa19e37e1bf6d5cfb23d59988d397f9ba6e79cf6853606e45a6809e0ca9a7b5d

The results of step 3 are used as the value of the signature parameter.

IP Whitelist Registration

ESPAY server also filters the IP address which accesses the ESPAY server. So please contact ESPAY team to register your IP.

Table Error

| Response Code | Description |

| 0000 | COMPLETED SUCCESFULLY |

| 9999 | SUSPECT / TIMEOUT |

| 802 | MAX/MIN PAYMENT AMOUNT EXCEEDED |

| 801 | TRANSACTION ERROR, INQUIRY DATA NOT FOUND |

| 800 | INSUFFICIENT FUNDS |

| 614 | UNABLE TO PROCESS TRANSACTION AT CERTAIN HOURS |

| 612 | UNABLE TO PROCESS TRANSACTION, PLEASE TRY AGAIN LATER |

| 611 | TRANSACTION DECLINE, PLEASE CONTACT YOUR ADMINISTRATOR |

| 610 | YOU CAN PERFORM THE SAME TRANSACTION IN 5 MINUTES |

| 601 | IP ADDRESS REJECTED / UNREGISTERED |

| 406 | INQUIRY DATA IS INVALID |

| 405 | PRODUCT DENIED |

| 404 | PRODUCT NOT AVAILABLE |

| 403 | AMOUNT IS NOT SET |

| 300 | INQUIRY NOT AVAILABLE |

| 210 | DUPLICATE UUID |

| 205 | INVALID REQUEST |

| 040 | BILLER SYSTEM MALFUNCTION |

| 09 | REQUEST IN PROGRESS |

| 13 | TXN AMT IS DIFFER WITH TOTAL BILL AMT |

| 14 | PAYMENT NBR NOT FOUND |

| 15 | NO SUCH ISSUER |

| 17 | SERVICE UNAVAILABLE (MAINTENANCE) |

| 18 | DISPUTE |

| 22 | SUSPECTED MALFUNCTION |

| 34 | SUSPECTED FRAUD |

| 36 | RESTRICTED |

| 60 | CARD ACCEPTOR CONTACT ACQUIRER |

| 61 | TRANSACTION EXCEEDS APPROVAL AMOUNT LIMIT |

| 64 | ORIGINAL AMOUNT INCORRECT |

| 65 | EXCEED FREQUENCY LIMIT |

| 66 | CARD ACCEPTOR, CALL ACQUIRER SECURITY |

| 67 | HOT CARD RETAIN CARD |

| 68 | LATE RESPONSE FROM BILLER |

| 72 | VOUCHER / DENOM NOT AVAILABLE |