Introduction

ESPAY | Payment Gateway Indonesia

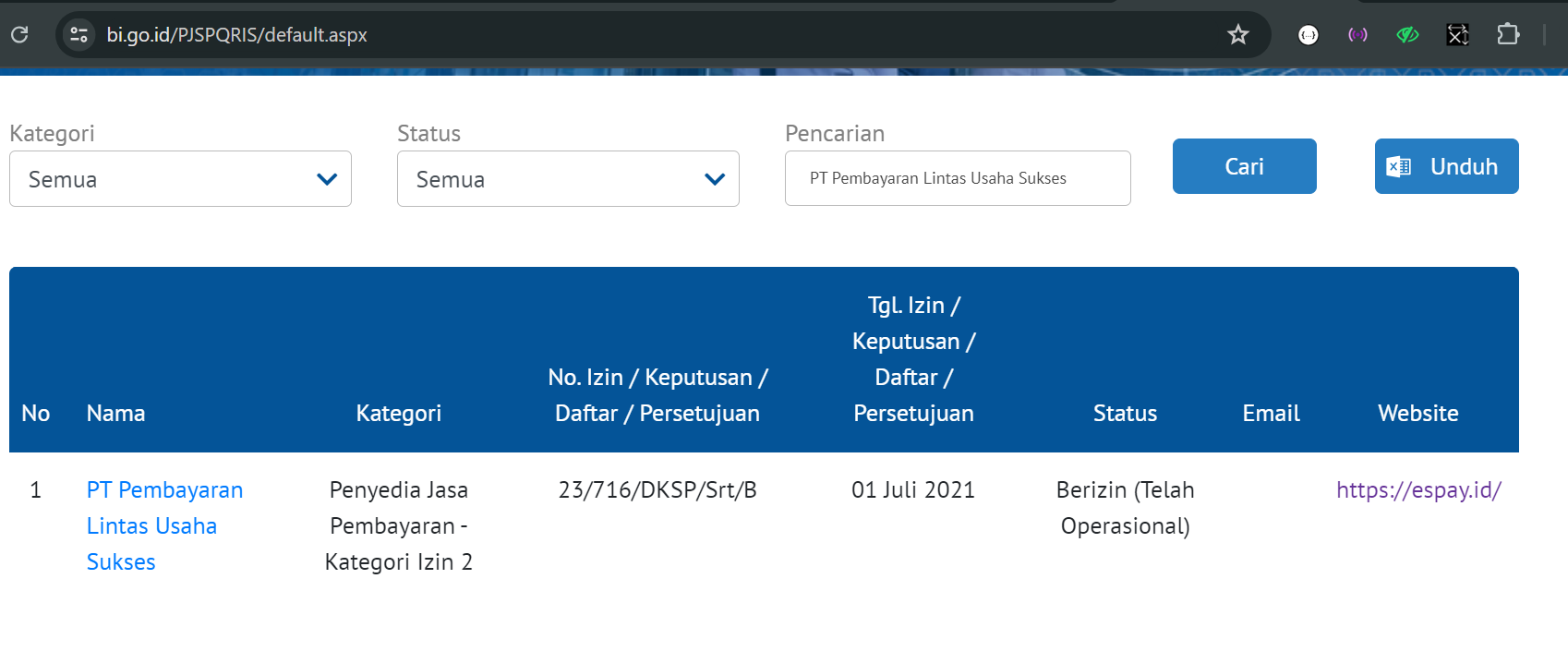

ESPAY is a payment gateway product in Indonesia which has become a featured product of PT Pembayaran Lintas Usaha Sukses (PT PLUS). Espay also has been registered in Bank Indonesia. Based on Bank Indonesia’s Letter No. 23/716/DKSP/Srt/B issued on 01 July 2021, PT Lintas Lintas Usaha Success (PT PLUS) has officially received a permit / license from Bank Indonesia as the Payment Gateway Provider Company https://www.bi.go.id/PJSPQRIS/default.aspx

ESPAYoffers a comprehensive payment solution for online (e-commerce) and offline (merchants), both business to consumers (B2C) and business to business (B2B). Espay also raised the concept of B2C2B which fulfills the payment needs in various industries to support a good payment ecosystem for the process of receiving payments (Cash In) and the distribution of payments (Cash Out) that are needed by customers to do business with their business partners (suppliers, delivery services, invoicing)

Our Payment Channels:

- Card (Visa / MasterCard / Amex / JCB)

- E-Wallet (LinkAja, GoPay, OVO, Dana, Cashbac)

- *Corporate Internet Banking(KlikBCA Business, Permata e-Business)*

- Internet Banking (BCA Klikpay, e-Pay BRI, Danamon Online Banking, PermataNet pay)

- Outlet Modern Market (Alfamart,Pos Indonesia, Pegadaian)

- ATM

- Branchless Banking Agent

- Bill Payment

- SMS Gateway

- Customer Due Diligent (regulatory solution)

- Invoice

- EIPP (Effective Collection No IT Knowledge Required)

Some benefits of using ESPAY:

-

Streamlined integration

The integration process is carried out efficiently (not using a lot of resources) to get maximum results

-

Pay As You Use

Only pay for what you use, no other fees.

-

Scale automatically

The convenience that you can get from automatic changes

-

One Tool to Find Them All

we simplify the complexity of a various payment method to provide you an effortless solution to get comprehensive payment solution