Customer Due Diligence

In Indonesia, the principle of getting to know the customer is initially in the Bank Indonesia Regulation (PBI) no. 3/10 / PBI / 2001 regarding the application of Know Your Customer Principles, as last amended by PBI-No. 5/21 / PBI / 2003. The principle of getting to know the customer in this PBI is "the principle used by banks to identify the customer's identity, monitor customer transaction activity, and report suspicious transactions which include:

- Financial transactions that are inconsistent with the profile, characteristics or habits of the customer's transaction patterns;

- Financial transactions of clients that raise reasonable suspicions that they are intended to prevent relevant transactions from being reported by banks under the provisions of Law No 15 of 2002 on money laundering, as amended by Law No 25 to be implemented in 2003; or

- Financial transactions that are made or canceled using assets suspected to be derived from proceeds of crime. "(Article 1 (2) and (5)).

In 2009 PBI no. 5/21 / PBI / 2003 regarding the application of Know Your Customer Principles, which is provided by PBI No. 28.11.2009 / PBI / 2009 on the implementation of anti-money laundering and anti-terrorist financing programs for commercial banks listed under PBI No. Updated 14/27 / PBI / 2012 related to efforts to prevent money laundering and terrorist financing using banking facilities and products, the term "know your customer" is changed to "customer due diligence" (CDD).

CDD is an identification, verification and monitoring activity performed by the bank to ensure that the transaction matches the profile of the prospective client, WIC (walk-in customer) or customer.

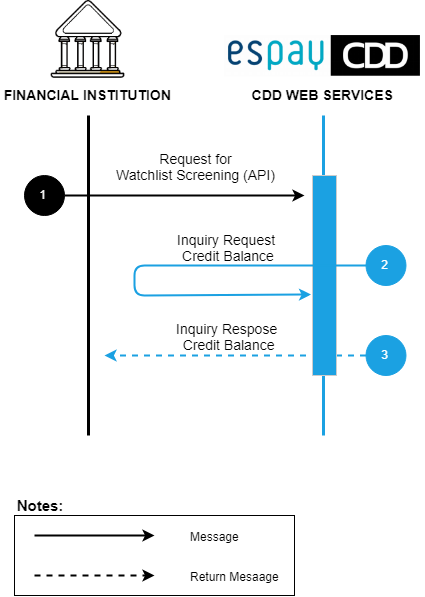

ESPAY CDD help you to know your customers

CDD (Customer Due Diligence) is a term used by the Financial Services Authority to encourage financial service providers to better understand their service users. There is an ongoing concern that the development of products, activities and information technologies will open a gap for irresponsible parties to use financial services providers to support their crime, including money laundering and terrorist financing.

Therefore, financial services providers need to implement an optimal and effective APU and PPT program. The implementation of anti-money laundering and terrorist financing programs is not only relevant to the fight against money laundering and terrorist financing but can also reduce the risks involved, including legal, reputational and operational risks

CDD Process

Identification → Verification → Observation

Espay CDD plays a role in the review process to identify high-risk customers. For the monitoring process, Espay CDD helps detect changes in existing customer risk through a batch scan

CDD procedures are carried out by financial service providers if / when:

- They maintain business relationships with potential customers;

- There is an IDR currency transaction/equivalent of at least 100 million IDRs.

- There is a fund transfer transaction.

- There are indications of suspicious financial transactions (TKM), money laundering and terrorist financing.

- There are doubts about the information provided by potential customers, customers, agents and / or beneficiaries.